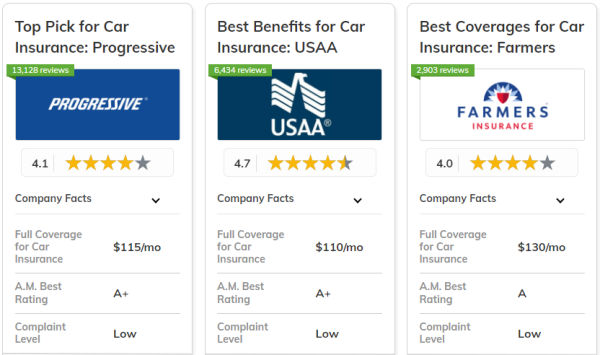

best of best car insurance

Newsthree.biz.id may we always be blessed. At This Point I want to share tips about the useful ABOUT CAR. Article Reports About ABOUT CAR best of best car insurance keep reading until finished.

Table of Contents

Understanding Car Insurance Coverage: A Comprehensive Guide

**Best Car Insurance: Understanding Coverage for Optimal Protection**

Car insurance is an essential aspect of responsible driving, providing financial protection against unforeseen events. Navigating the complexities of insurance coverage can be daunting, but understanding the key components is crucial for making informed decisions.

**Liability Coverage: A Legal Necessity**

Liability coverage is the foundation of car insurance, protecting you from financial responsibility if you cause an accident that results in bodily injury or property damage to others. It covers medical expenses, lost wages, and legal fees for the injured party.

**Collision and Comprehensive Coverage: Protecting Your Vehicle**

Collision coverage safeguards your vehicle from damage caused by a collision with another object, while comprehensive coverage extends protection to non-collision-related incidents such as theft, vandalism, and natural disasters. These coverages are essential for safeguarding your investment in your car.

**Uninsured/Underinsured Motorist Coverage: Peace of Mind**

Uninsured/underinsured motorist coverage provides protection in the event of an accident with a driver who lacks adequate insurance or has insufficient coverage to cover your damages. This coverage ensures you are not left financially vulnerable in such situations.

**Medical Payments Coverage: Covering Medical Expenses**

Medical payments coverage helps pay for medical expenses incurred by you or your passengers in an accident, regardless of fault. It covers expenses such as hospital bills, doctor's visits, and rehabilitation costs.

**Personal Injury Protection (PIP): Additional Medical Coverage**

PIP coverage provides broader medical coverage than medical payments coverage, including lost wages, funeral expenses, and other related costs. It is particularly beneficial in states with no-fault insurance laws.

**Additional Coverage Options: Tailoring to Your Needs**

Beyond these essential coverages, various additional options can enhance your protection. Rental car reimbursement coverage provides a rental car while your vehicle is being repaired, while roadside assistance coverage offers assistance with flat tires, dead batteries, and other emergencies.

**Choosing the Right Coverage: A Balancing Act**

Determining the optimal coverage for your needs requires careful consideration. Factors to consider include your driving history, the value of your vehicle, and your financial situation. It is advisable to consult with an insurance agent to assess your specific risks and tailor a coverage plan that meets your requirements.

**Conclusion**

Understanding car insurance coverage is paramount for making informed decisions and ensuring adequate protection on the road. By carefully evaluating your needs and selecting the appropriate coverages, you can safeguard yourself, your vehicle, and your financial well-being in the event of an accident. Remember, the best car insurance is the one that provides comprehensive coverage and peace of mind while driving.

Comparing Car Insurance Quotes: Tips for Finding the Best Deal

**Comparing Car Insurance Quotes: Tips for Finding the Best Deal**

Securing the best car insurance deal requires a thorough comparison of quotes from multiple providers. Here are some essential tips to guide you through the process:

**1. Gather Your Information:**

Before requesting quotes, gather necessary information such as your driving history, vehicle details, and coverage needs. This will ensure you receive accurate and tailored quotes.

**2. Use Online Comparison Tools:**

Numerous online comparison tools allow you to compare quotes from multiple insurers simultaneously. These tools provide a convenient and efficient way to explore different options.

**3. Consider Your Coverage Needs:**

Determine the level of coverage you require. Basic liability insurance is mandatory, but you may also consider comprehensive and collision coverage for additional protection.

**4. Check for Discounts:**

Many insurers offer discounts for factors such as good driving records, multiple policies, and safety features in your vehicle. Inquire about these discounts to reduce your premiums.

**5. Compare Deductibles:**

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but ensure you can afford the deductible in case of an accident.

**6. Read the Fine Print:**

Carefully review the terms and conditions of each policy. Pay attention to exclusions, limitations, and any additional fees or charges.

**7. Consider Your Credit Score:**

In some states, your credit score can impact your insurance premiums. Maintaining a good credit score can help you secure lower rates.

**8. Get Referrals:**

Ask friends, family, or colleagues for recommendations on reputable insurance providers. Referrals can provide valuable insights into the quality of service and customer satisfaction.

**9. Negotiate:**

Once you have received several quotes, don't hesitate to negotiate with insurers. Explain your situation and inquire about any potential discounts or adjustments.

**10. Make an Informed Decision:**

After comparing quotes and considering all factors, make an informed decision based on your coverage needs, budget, and the reputation of the insurer. Remember, the best car insurance deal is the one that provides adequate protection at a reasonable cost.

Navigating Car Insurance Claims: A Step-by-Step Process

Navigating Car Insurance Claims: A Step-by-Step Process

Filing a car insurance claim can be a daunting task, especially if you've never done it before. However, by following a step-by-step process, you can ensure that your claim is handled smoothly and efficiently.

**Step 1: Report the Accident**

Immediately after an accident, it's crucial to report it to your insurance company. Most policies require you to do so within a certain timeframe, typically 24 to 48 hours. You can report the accident online, over the phone, or through your insurance company's mobile app.

**Step 2: Gather Evidence**

Documenting the accident is essential for supporting your claim. Take photos of the damage to your vehicle, the other vehicles involved, and the scene of the accident. If possible, obtain contact information from any witnesses.

**Step 3: File a Claim**

Once you've reported the accident, you'll need to file a formal claim. This can be done online, over the phone, or in person at your insurance company's office. You'll need to provide details about the accident, including the date, time, location, and the other vehicles involved.

**Step 4: Cooperate with the Insurance Company**

Your insurance company will assign an adjuster to handle your claim. The adjuster will investigate the accident, review the evidence you've provided, and determine the amount of coverage you're entitled to. Cooperate fully with the adjuster and provide any additional information they request.

**Step 5: Review the Settlement Offer**

Once the adjuster has completed their investigation, they will present you with a settlement offer. This offer will include the amount of money the insurance company is willing to pay for your damages. Carefully review the offer and consider whether it is fair and reasonable.

**Step 6: Negotiate (Optional)**

If you're not satisfied with the settlement offer, you can negotiate with the insurance company. Be prepared to provide evidence to support your request for a higher settlement. You may also want to consider consulting with an attorney.

**Step 7: Accept or Reject the Settlement**

Once you've reached an agreement with the insurance company, you'll need to accept or reject the settlement offer. If you accept, you'll receive payment for your damages. If you reject, you may have to pursue legal action to recover compensation.

**Conclusion**

Navigating car insurance claims can be a complex process, but by following these steps, you can ensure that your claim is handled fairly and efficiently. Remember to document the accident thoroughly, cooperate with the insurance company, and carefully review the settlement offer before making a decision.

That's the complete summary about ${title} in about car that I provided Hopefully you get benefits from this article always be grateful for your achievements and maintain lung health. Please share it with people in around you. Thank you for your attention

✦ Tanya AI